5 May 2024

The Potential of Digital Economies in South Asia

India, Pakistan, and Bangladesh have a combined population of 1.8 billion people – almost one-quarter of the Earth's entire population. Brutal political and societal conflict fractured the former British Raj into India and Pakistan in the1947 Partition, then split Pakistan in two with Bangladesh's independence in 1971.

Continued territorial disputes and simmering resentment between India and Pakistan from the Partition make tensions between nuclear-armed India and Pakistan among the most dangerous in the world. There is no clear path in present times to ending these tensions; with both nations leaning politically further into religious identity, a clear path seems to be far away indeed.

Bangladesh for its part has committed to the prohibition of nuclear weapons, and has a mutual defense agreement with neighboring China. Rather than any difficulty with India or Pakistan, Bangladesh is consumed by the challenges of being by far the most densely populated nation (excluding micro-countries) in the world and with handling large numbers of ethnic cousins from neighboring Sino-Tibetan Myanmar.

The Outlook for Digital Economies

So what's the plan to create Digital Economies in a region holding 1 in 4 of the world's people? “Complexity” is not a complex enough word to describe the linguistic and societal diversity embedded throughout the region's regions, with a recorded history stretching back more than 5,000 years.

Civilizations that at one time seemed invincible and immortal – the Harappan Empire prior to 3000BC, the Mughals of the 1500s to 1900s, the seven BCE centuries of Buddhist Pyu city-states, the Mon Kingdom for five centuries in the Common Era, to name just a few among dozens – all vanished into the wind at one time or another, with the current political states all existing for just a few decades.

How does one being to get a grip on a place as vast as this, as densely packed with people as this, as confoundingly historic as this, and yes, as hot as this? Certainly the current bosses of each nation are striving mightily to get such a handle, albeit in blunt, power-laden ways, each of them taking their nations into specific, single directions. There is no hint of any desire to unite the three nations into a single country that would be the world's largest, and likely stay that way until the end of human time.

Observers and investors from outside the three-nation region can be forgiven for examining all of India, Pakistan, and Bangladesh under a single lens and try to get a focused view of what has been accomplished and what can potentially be accomplished here.

IDCA Digital Readiness Scores in Focus

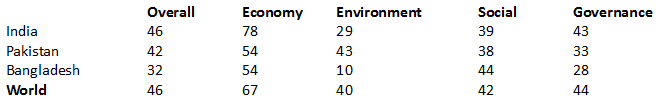

A high-level view can start with the IDCA Digital Readiness Index and how it views the three nations. The most current results, overall and in the Index's four categories (all scored on a 0-100 scale) are shown in the following table:

A Look at India

India, with three-quarters of the region's population and 83% of its GDP, might hypothetically represent the region's largest opportunity, but it is also the most self-sufficient of the three; Prime Minister Narendra Modi is expected to get elected to a third term at the end of the current, ongoing election, his support stemming from a steadily improving economy and a grand vision for the country.

India has several major data center hubs. Mumbai tops the list, with its 500+ MW capacity now reaching about half of that of Tokyo and Singapore in Asia. Add to this data centers that are planned or already under construction, and Mumbai is expected to grow by 500% in the next few years and soar to the leadership position in all of APAC.

Chennai and Hyderabad are also projected to grow into serious hubs, with around 750MW of data center installations by 2028. Delhi and Pune together are also projected to reach that amount, and Bangalore (known more for BPO than as a data center hub) is projected to emerge into the lower hundreds of megawatts, too.

Meeting its growing energy challenges with sustainable power is a big topic of conversation in India, inside and outside of the data center industry. One colossal idea, reported earlier by IDCA, would bring 30GW of power online in Gujarat Province, located just north of the greater Mumbai area.

India is expected to receive about $18 billion in foreign direct investment (FDI) over the current year, with about 20% focused on digital infrastructure. Of the overall FDI total, 9% is coming from the US and 7% from Western Europe. The overall amount is less than 0.5% of India's total economy, illustrating the nation's seeming financial independence.

A Look at Pakistan and Bangladesh

Pakistan attracts a similar percentage of FDI (running at $1.5-2.0 billion annually), while Bangladesh attracts a slightly higher, 0.8% (running at about $3.5 billion per year). Both of these nations would benefit from much higher levels of outside investment, but Pakistan's instability and Bangladesh's tilt toward China can easily cool any large, Western investment ideas.

Their current data center footprints are quite modest, in sharp contrast to the development going on throughout neighboring India. None of their cities is currently projected to reach even emerging status within the next few years, something that would require only a couple of tens of megawatts of newly installed capacity. Both nations consume on the order of 0.1% of their electricity grids through their collective data servers.

The two nations' lack of foundational digital infrastructure permeates upwards, leading to internet access rates, bandwidth, and mobile networks that are below the world average. Pakistan has 40% more people than Bangladesh, but only about half the per-person income. This latter fact places Bangladesh in the Frontier Markets group, the fourth of five income tiers we use at IDCA Research, and places Pakistan in the fifth tier, known in economics as the Least-Developed Countries (LDCs).

Renewable Energy in Pakistan and Bangladesh

Pakistan does have one major bright spot: it's renewable-energy grid is above the world average, and supplies 46% of its energy. About 16% of Pakistan's electricity consumption comes from nuclear power, something that must also give pause to potential investors who realize Pakistan's status as a nuclear-armed power. Bangladesh has no nuclear power, and a weak sustainability infrastructure, with only about 2% of its electricity coming from renewable resources.

How Do They Compare Among Their Economic Peers?

So how do India, Pakistan, and Bangladesh compare to their economic peers? India's prodigious progress over the past three decades has given it one of the world's largest economies. Its economy is now larger than any in Europe with the exception of Germany. It's surpassed France and the UK, and sits in a virtual tie with Japan as the world's fourth-largest economy. Yet its enormous population keeps India's per-person income that's still at only 25% of the world average, and just 3% of the US. India thus lies within the fourth-tier, Frontier Markets category, along with Bangladesh.

India's overall IDCA Digital Readiness Index score places it 6th among the 30 Frontier Markets covered by IDCA Research, in a virtual dead heat with Kenya. Countries ahead of it include small Mauritius and larger Vietnam. Bangladesh sits near the bottom of the Frontier Markets, penalized heavily by its lack of renewable energy.

Pakistan sits 8th among the 30 LDCs covered specifically (and dozens more covered collectively) by IDCA Research. Rwanda and a few other East African nations lead this group, while Pakistan's score is similar to that of Zambia, which is considered to be in Southern Africa.

Looking at Individual Potential

Each of the three nations examined here have tremendous lifts facing them to achieve significant socioeconomic improvement and create viable Digital Economies. Lest the data presented here and its interpretations appear harsh, I must stress that there is much cause for optimism and opportunity in each of the three countries.

This is little to no chance that the three will unify into a larger nation, or even deign to cooperate with one another in a meaningful way. But we're happy to discuss with policymakers, investors, and others with an interest in South Asia in what individual potential might lie within these three deeply historic nations.

Follow us on social media:

.d57b427b.png&w=3840&q=75)