IDCA News

All IDCA News

22 Aug 2023

Softbank IPO for Arm a Product of Human Irrationality

“People are irrational.” This line from the 70s movie The Paper Chase is not famous, but is timeless and perhaps profound. In a film focused on the struggle of law students to master rational thinking and apply it to the human condition, the reality of human irrationality frequently intrudes in its familiar, ugly way.

Irrationality rains on earnest investors' parades as well, often in a deluge. A current case in point involves chip designer Arm, for which Softbank paid $32 billion in 2016, on the rational belief that the company, which dominates smartphone chip designs, would be able to track rational human behavior through the use of the ubiquitous devices worldwide.

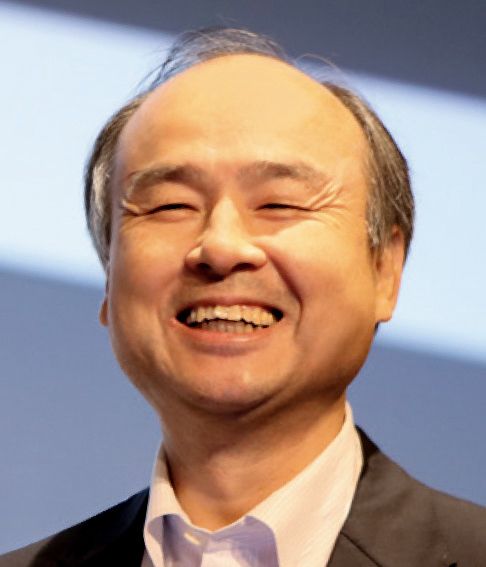

Instead, the company has lost billions of dollars, as the sudden, inexplicable, irrational shift in interest among people and companies in a new generation of AI fueled an interest in massive, centralized computing resources and the high-performance GPUs needed to optimize them. The highly decentralized collection of billions of pinpoints of human-driven data suddenly became less of what Softbank CEO Masoyoshi Son thought would be a crystal ball and more of a cement boat anchor.

A public offering for Arm filed on Monday, August 21 may reap tens of billions of dollars soon, restoring some faith in Son's vision of rationality. Son and company had previously tried to sell Arm to GPU king Nvidia for a reported $40 billion, but was unsuccessful in closing the deal.

Meanwhile, public-company Nvidia's stock has more than tripled in value so far this year, propelling the company into the rarefied world of trillion-dollar valuation. Ironically enough, Son sold a 5% stake in Nvidia in 2019 for $3.6 billion – stock that is worth about $60 billion today.

As noted 50 years ago during a time when the tech business of today was inconceivable, people are indeed irrational.

Follow us on social media: