IDCA News

All IDCA News

1 Nov 2022

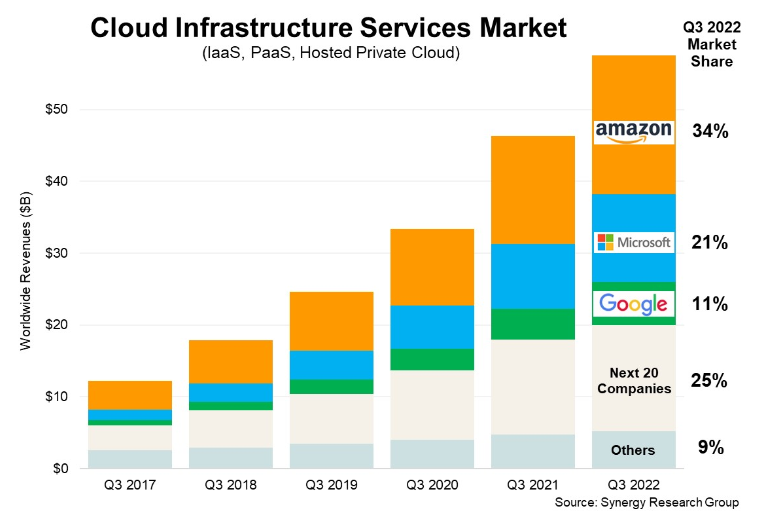

Digital Cloud Spending Is Rising, Hitting $57 Billion for Q3 as Google Steadily Improves Its Market Share

Cloud infrastructure services saw huge investments this quarter as the world prepares for an economic slowdown.

Synergy Research estimates that enterprises spent more than $57.5 billion primarily on the hyper-scalers this year, an $11 billion increase from last year.

Despite the positive impact of a strong dollar and a slowing Chinese market, both helped to grow to spend.

Even though Google Cloud is still losing money, it managed to increase its market share to 11 percent. However, it still falls behind Microsoft (21 percent) and Amazon (34 percent).

Within the top five, you'll find Alibaba and IBM at three percent each, Salesforce and Tencent at two percent each, and Oracle at two percent.

Baidu, China Telecom, China Unicom, Huawei, Fujitsu, NTT, Snowflake, SAP, and Rackspace.

"It is a strong testament to the benefits of cloud computing that despite two major obstacles to growth, the worldwide market still expanded by 24 percent from last year. If exchange rates remained stable and the Chinese market remained on a more normal path, then the growth rate percentage would have been well into the thirties," said John Dinsdale, a chief analyst at Synergy Research Group.

"The three leading cloud providers all report their financials in US dollars, so their growth rates are all beaten down by the historical strength of their home currency. Despite that, all three have increased their share of a rapidly growing market over the last year, which is a strong testament to their strategies and performance."

"Beyond these three, all other cloud providers, in aggregate, have been losing around three percentage points of market share per year but are still seeing strong double-digit revenue growth. The key for these companies is to focus on specific market portions where they can outperform the big three." He added.

As the economy slows, Amazon Web Services warned that customers were cutting back on cloud spending, while Microsoft Azure came up short on analyst growth projections.

Also, Read Netflix Turns to Amazon Web Services to Manage Cloud Costs

Follow us on social media: