IDCA News

All IDCA News

9 Jan 2023

The Challenge of Monstrous Data Growth, Part I

Data growth is being turbocharged today. Already projected to clip along at around 25% per year – thereby doubling every three years – the worldwide growth of data might only increase even higher rates with the increasing use of GPUs to facilitate video and complex visualizations, and with the coming emergence of the industrial metaverse.

The IDCA's Bruce Taylor recently wrote about the metaverse and its potential to rock the world's digital infrastructure. His article outlines a demand for new data centers and the electricity that will power them that presents a major challenge to the world's investors, builders, and governments. Bruce, like all responsible writers, pointed out that Meta's (Facebook's) shoddy implementation of a consumer metaverse is not any kind of example to use in discussing the industrial metaverse.

The Zettabyte Era

The background context of Bruce's thoughts is this: the Internet processed more than a zettabyte of data in 2016. A zettabyte can also be expressed as 1,000 exabytes or 1 million petabytes. This was not only a significant milestone, but an unimaginable one at the dawn of the new millennium.

The 25% figure I cited above comes from an examination of data growth from Cisco, published during the time that zettabyte threshold was reached. The report was updated in 2020, and takes us through this year, 2023. There are myriad data points and projections in it that I'll be tracking down over the course of the year.

Further, the amount of digital data existing in the world – stored in data centers, personal devices, and anything else with processing power and storage – reached a zettabyte in 2012, and is expected to reach 100 zettabytes this year.

How Much Juice Do We Need?

Prompted by these alarming numbers, I did a study in 2018 of the worldwide electricity consumption of data centers. The study found that data centers will use 2.8% of the world's power grid this year, which happens to be in line with Digital Realty's figure of 3%.

This will be a confusing year for statisticians, as in making projections they must grapple with any negative skewing from the Covid pandemic in 2020-2021 and potentially anomalous rapid growth in 2022. Everyone's looking for this year to a year of re-established normalcy.

That said, a discussion of data center power requirements doesn't need to drill down to fine-tuned levels. Getting the general picture will suffice, just as generally positive action by governments, enterprises, and investors will suffice. We don't want to get caught short.

My 2018 study found the following fun facts, given modest growth in available electricity, modest improvements in server-system efficiency, continued population trends, and continued growth in the number of servers based on then-current trends:

* The number of servers deployed in the world will almost triple, to 347 million in 2030. That number will rise more then fourfold by 2040, to more than 1.5 billion

* Data center electricity consumption will rise to 5.4% of the global grid by 2030, and 13% by 2040

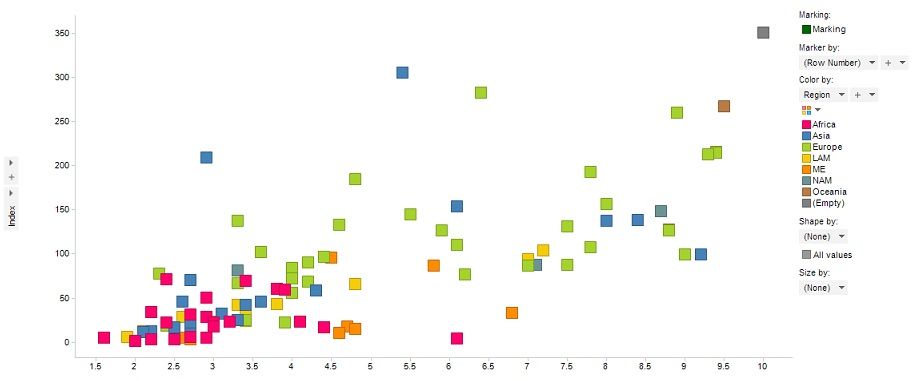

* Overall electricity demand in the world will continue to shift to the developing world. The developed world still commands 41% of the grid in 2023; this will fall to 34% by 2030 and 24% by 2040.

A quick summary of the situation shows that server growth specifically and electricity demand in general will require a more aggressive deployment of electricity over these years. This new power must be created in the face of GHG-abatement initiatives and Net-Zero emissions strategies.

(The second part of this article details the technology and GHG-abatement challenge the world faces, particularly within developing nations.)

Follow us on social media: